Enhance Your Forex Trading with a Trading Journal App

A trading journal is an essential tool for traders aiming for consistent profits in the volatile world of forex. The ability to track, analyze, and reflect on your trades is invaluable. By logging every trade you make along with the reasoning behind each decision, you create a roadmap of your trading journey. In this digital age, leveraging a forex trading journal app Vietnamese Trading Platforms can enhance this experience, but nothing compares to having a dedicated forex trading journal app. Let’s explore why every forex trader should consider using such apps and what features they should look for.

What is a Forex Trading Journal App?

A forex trading journal app is a mobile or desktop application designed to help traders track their trades, analyze performance, and enhance trading strategies. Unlike traditional methods, an app allows for quicker entry and management of trade logs and offers additional features like analytics, reports, and insights into trading behavior.

Benefits of Using a Forex Trading Journal App

1. Structured Trade Record Keeping

One of the prominent advantages of using a journal app is structured recordkeeping. Traders can log essential trade data, including entry and exit points, lots traded, reasons for entering a trade, and the emotional state during the trade. This structured approach simplifies future analysis and helps uncover patterns that may otherwise go unnoticed.

2. Performance Tracking and Analytics

Most forex trading journal apps come equipped with analytics tools. These features can help traders track their performance over a specified period, such as win rates, average returns, and the effectiveness of various trading strategies. By understanding which tactics work and which don’t, traders can become more proficient in their decision-making.

3. Emotional Awareness and Improvement

Trading can be an emotional rollercoaster. The pressures of the market can lead to impulsive decisions, which detrimentally affect performance. By logging emotional states attached to trades, traders can recognize patterns of emotional responses and subsequent outcomes. A journal app helps to identify when emotions may have skewed judgment and to condition traders to make more rational decisions.

4. Strategy Optimization

Every trader has their unique strategies, and a trading journal app allows you to document and refine these strategies over time. With sufficient data collected, you can evaluate how particular strategies perform under various market conditions. This information is vital for optimizing your trading strategies to maximize profit and minimize loss.

5. Goal Setting and Performance Reviews

Setting clear trading goals is a crucial aspect of any trading plan. A journal app can help you establish these objectives, whether they be profit targets, risk management guidelines, or skill development milestones. Regularly reviewing your goals relative to your performance can provide motivation and accountability, pushing you to achieve your trading aspirations.

Key Features to Look For in a Forex Trading Journal App

1. User-Friendly Interface

The best trading journal apps are user-friendly and intuitive. A clean design and easy navigation ensure that traders can quickly log trades without getting bogged down by complex processes.

2. Customizable Fields

Since different traders focus on different aspects of their trading, customizable fields allow users to tailor the journal to fit their unique trading styles. This personalization can enhance the relevance of the recorded data.

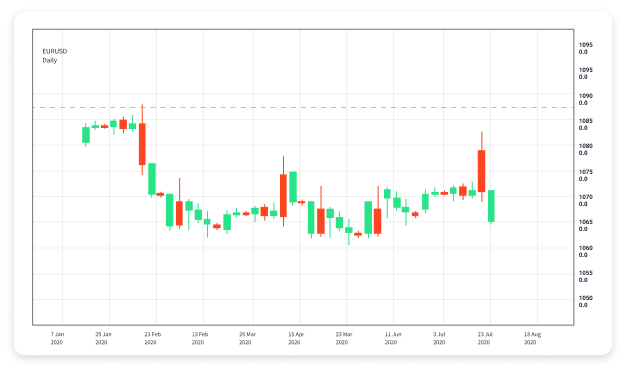

3. Data Visualization Tools

Visual representation of data can often highlight trends and problems that numbers alone may conceal. Look for apps that include charts and graphical reports for quick performance assessments.

4. Mobile and Desktop Compatibility

Accessibility is crucial for a trading journal app. Look for cross-platform capabilities that allow you to log trades on both mobile and desktop devices. This flexibility ensures that you can take your journal wherever you go, logging trades in real-time.

5. Integration with Trading Platforms

Some journal apps integrate with popular trading platforms. This feature can automatically pull trade data into your journal, reducing the manual data entry process and improving accuracy.

Popular Forex Trading Journal Apps

Several well-known forex trading journal apps are available on the market today. Here’s a quick overview of a few of them:

- TradeBench: A free and easy-to-use platform that offers performance tracking, goal setting, and strategy evaluation features.

- My Trade Journal: This app not only helps log trades but also provides detailed analytics and customizable templates.

- Edgewonk: A more advanced trading journal that allows for deep analysis of trades and features a psychological aspect to trading.

- TraderSync: This app automatically imports trades from most major brokers, making the tracking process seamless.

Conclusion

In the highly competitive world of forex trading, a trading journal app can be a game-changer. By aiding in structured record-keeping, performance tracking, emotional awareness, strategy optimization, and goal setting, these apps are indispensable tools for serious traders. As you consider the different options available, be sure to select an app that aligns with your trading style and offers the necessary features for your development. A disciplined approach enriched by data-driven insights will set you on the path to consistent trading success.